Preparing for a Financial Collapse

They’ve been harping on about it for years – but will it ever happen? Since 2008, financial analysts and economists have warned of a second collapse more significant than the first. After the initial crash, global governments strapped band-aids over large wounds of a broken system that has been in dire need of a complete restructuring. So it’s no surprise that almost every day someone new appears on TV warning of the imminent collapse of our not-so-robust financial system that is buried under trillions in debt.

Whether you believe in the warnings or not, it’s always best to stay prepared and make sure that any assets you have are protected should the worst happen. In the modern world, there is an abundance of methods to diversify your investments to protect your wealth, and some stand out as more reliable than others.

Page Contents 內容目錄

What’s so great about Gold anyway?

Throughout all of human history, only one metal has shown time and time again to hold value despite all of our modern advancements and technological requirements – Gold.

Historically speaking (since the 15th Century) there have been 609 paper currencies which are no longer in circulation. Of these, around 153 were destroyed as a result of hyperinflation from over-issuance by their supporting governments. Towards the end of the 18th Century the French government famously attempted its own paper fiat currency (one of many abject failures) and by 1795 had inflation rates of around 13,000% leading to Napoleon’s implementation of the gold franc which stabilised the system during his reign. After the fall of these currencies one constant remained; the use of gold as a backup currency due to its inherent intrinsic value.

“An ounce of gold will always buy a good suit” – Old proverb which has remained true from Roman times, through the Tudor era and into the 19th 20th century even to today.

While there are many historical reasons to look to gold as a haven for investment during uncertain times, Gold has more value than just an excellent track record. There are only eight elements in the periodic table that are suitable for use as a currency. They are referred to as noble metals – osmium, iridium, ruthenium, palladium, platinum, rhodium, silver, and gold. They are all rare, but only silver and gold are available in enough quantities to comprise a practical money supply. The rest are either too limited in number or have melting points too high to make them commercially viable.

The Complications of Fiat Currency (Paper Money)

Gold holds intrinsic value, because unlike the dollars in your bank account, or the bitcoins in your e-wallet, gold is something that you can physically hold that cannot be printed, replicated, hacked or scanned into a computer system. The paper money in your wallet was initially backed by an ample government storage of gold to which bank notes were just guarantees of ownership for gold stored on your behalf by the government. Unfortunately, the amount of gold no longer comes close to the amount of paper money in circulation, meaning that in the event of a “loss of faith” in paper money, the reserves would run dry immediately. The entire value of the US dollar is now a psychological concept, and will only continue to hold value as long as people and businesses believe in it.

Arguments against investment in Gold

“There isn’t enough gold in the world to support finance and commerce.”

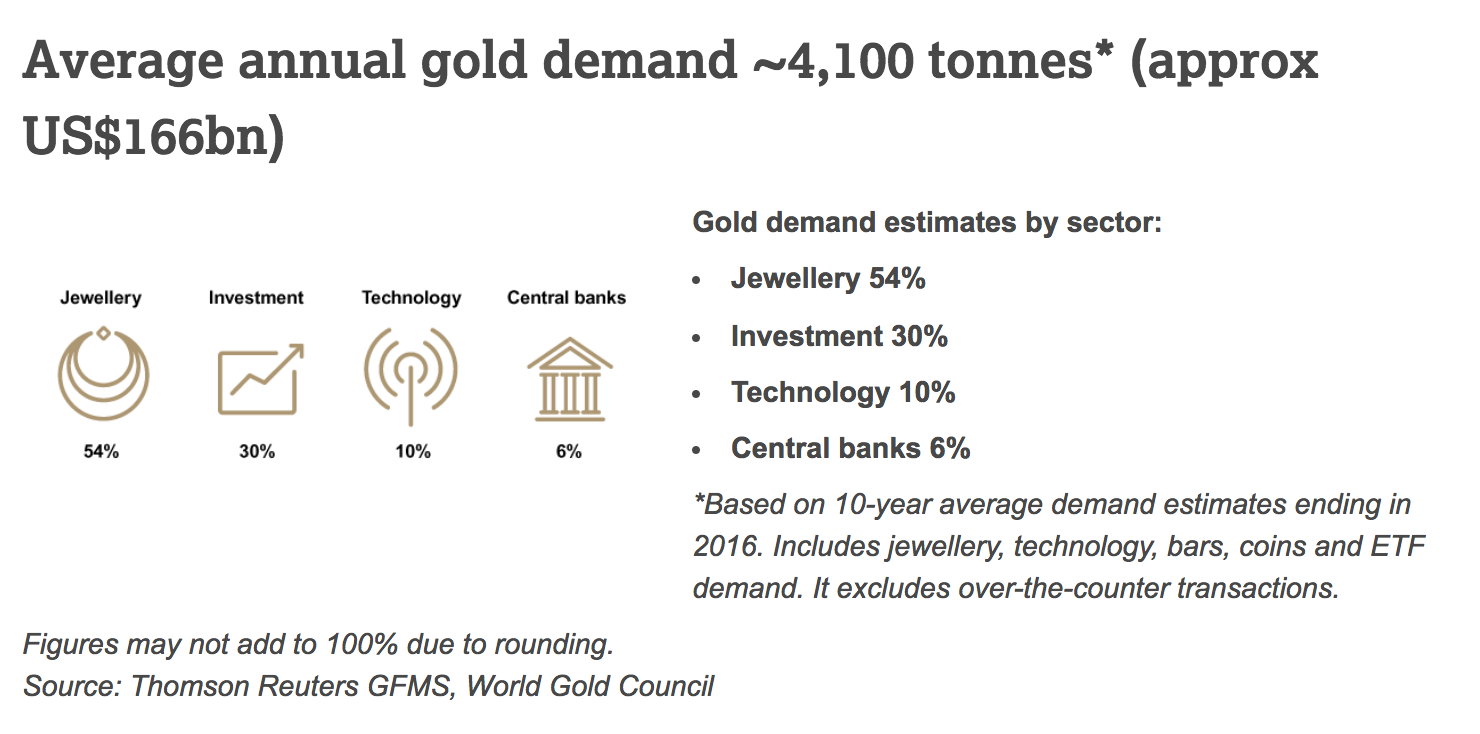

Current estimates suggest that the world has approximately one hundred and seventy thousand (170k) metric tons in total, and the amount of gold in circulation for trading in the world is always fixed at a level (less than 6%), subject to an unlikely increase in mining.

What critics mean when they say “there isn’t enough gold” is that there isn’t enough gold at current prices available for trading. There is always enough to use for a gold standard, as long as a stable, non-deflationary rate is established. England successfully used gold as a standard from 1815 to 1914 with around 20 percent gold backing for money. The same goes for the Federal Reserve in the U.S. from 1913 to 1965 approximately 40 percent gold backing for the money supply.

The confrontation doesn’t lie against gold as a standard but rather in the real value of paper money to physical gold. The actual conflict will begin when confidence in paper money erodes, and a gold standard gains favour as a way to restore our economic system.

“Gold is Not an Investment”

Warren Buffett famously criticised gold by stating that it offers no return and therefore no chance of compounding wealth, and he’s 100 percent right. Physical gold has no yield – if you buy an ounce of gold today, put it in a safe and take it out twenty years from now, it will still be one ounce of gold (utterly free from inflation). But that doesn’t make it a bad investment. Provided the financial collapse does happen, and fiat currencies do become worthless the value of gold will skyrocket. One ounce will still be one ounce but what you can buy with it will drastically increase.

“Gold was the cause of the Great Depression.”

Research shows that at no point in time during the Great Depression was the supply of money strained by the gold supply. There are multiple factors to blame for the Great Depression (mostly incompetent monetary and fiscal policies), but gold was not to blame. When gold is undervalued, central bank money is remodelled, and the result is inflation. For a gold standard to work, the price of gold can’t be undervalued, not back then and not today.

What Happens If the Monetary System Collapses?

A catastrophic failure of any major global financial system is a genuine threat and could happen without warning. The value of cash and various International fiat currencies would immediately drop rending them next to worthless. In these situations, people revert to trading locally and using precious metals as a currency. It’s essential that any precious metal you own is in smaller denominations – as it would be particularly difficult to trade a giant gold bar for some food should you need to. Keep coins if you can as they are small, easy to travel with and easy to split up into smaller amounts.

No matter what the analysts say, it’s never really here until it actually happens. While stocking up on gold and silver coins might seem a little extreme to some, this relatively simple measure could make a huge significant in the outcome of your future. Start small by investing a portion of your savings in precious metals to diversify your investment and over time grow this to the point where you are comfortable no matter what the financial outlook.