Physical platinum investment is an essential element in price discovery

The recent increase in the platinum price has heightened debate about the treatment and role of physical investment demand in market balances and price discovery. WPIC includes net physical investment (bar and coin and physically backed ETFs) as a component of platinum demand, and consequently also as a source of supply in the case of net disinvestment. This is the same analytical approach for industrial, jewellery and automotive platinum demand, where some metal becomes future supply from recycling. Excluding investment from demand to create an ‘industrial’ balance, can dissuade investors and harm sentiment, as price strength appears contrary to the ‘surplus’ suggested. This approach, paradoxically, warns that supply from investment is a material risk to a fall in short-term prices.

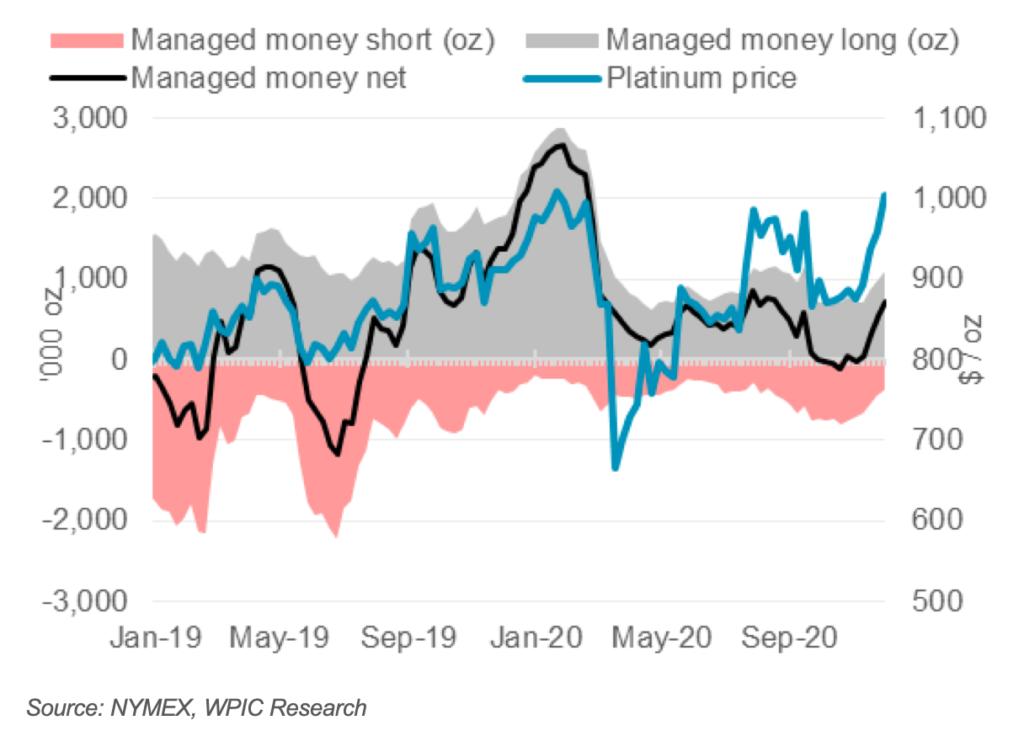

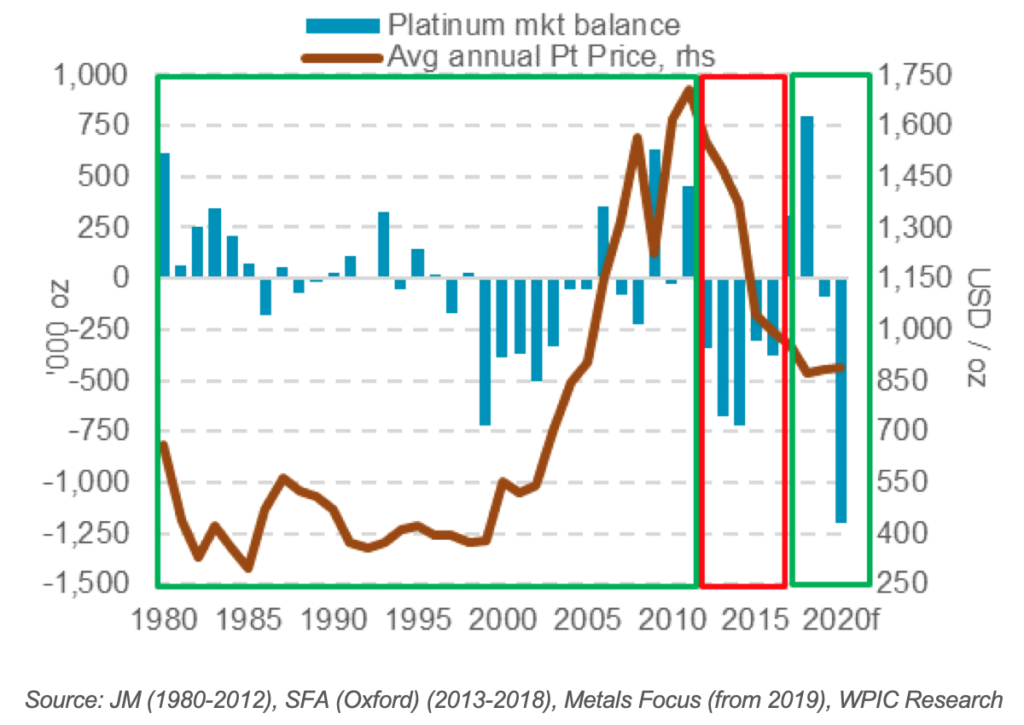

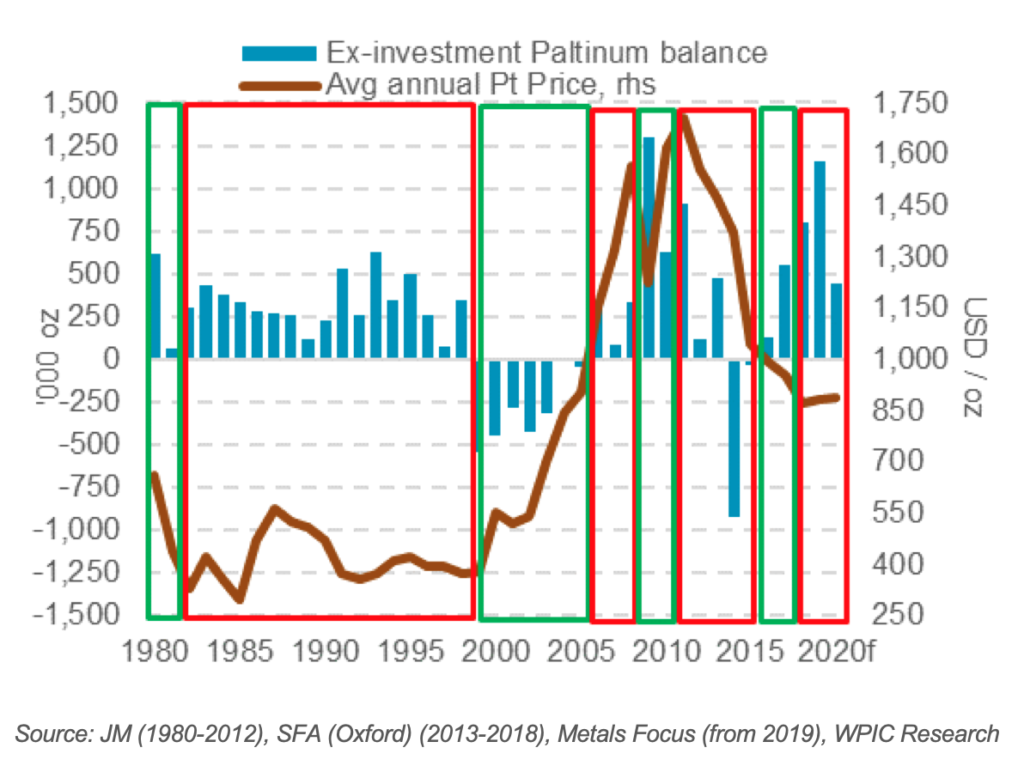

Figures 3 and 4 show that very short-term platinum price discovery is dominated by changes in futures positioning, while supply-demand balances influence annual price trends over two- to four-years. However, investors building physical holdings, in bars and coins and ETFs, reduces OTC metal availability and can drive short-term price moves. We believe excluding investment demand is unhelpful to investors with both short- and long-term outlooks.

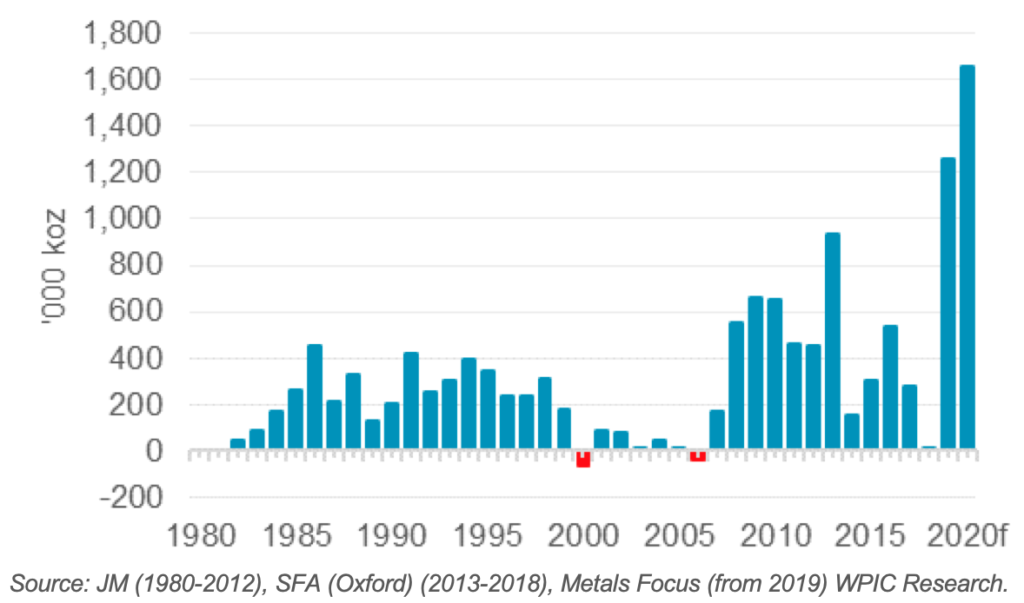

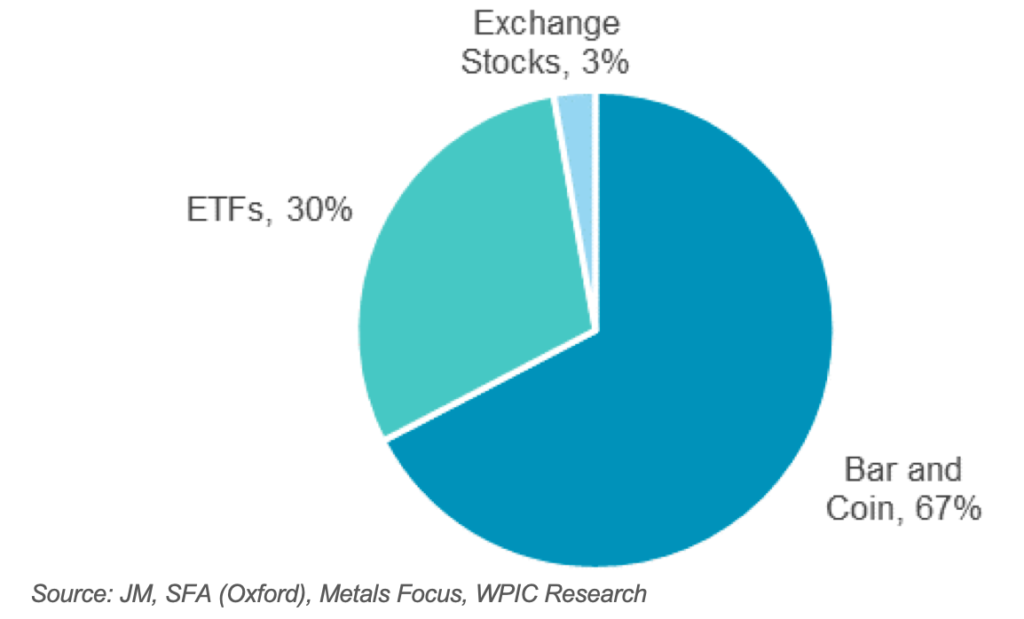

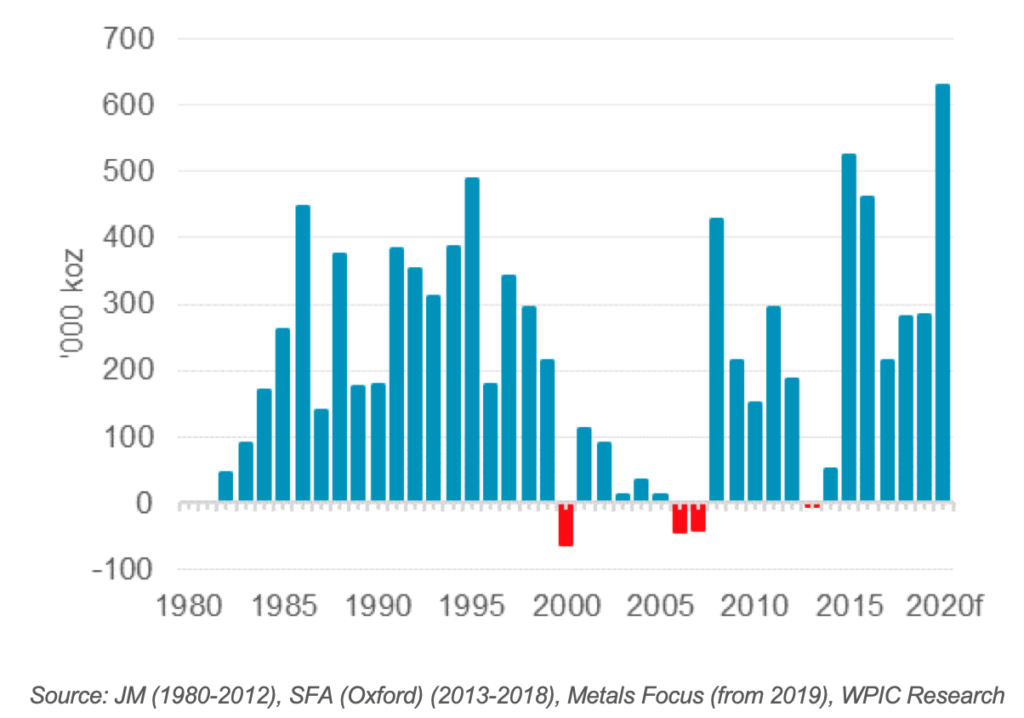

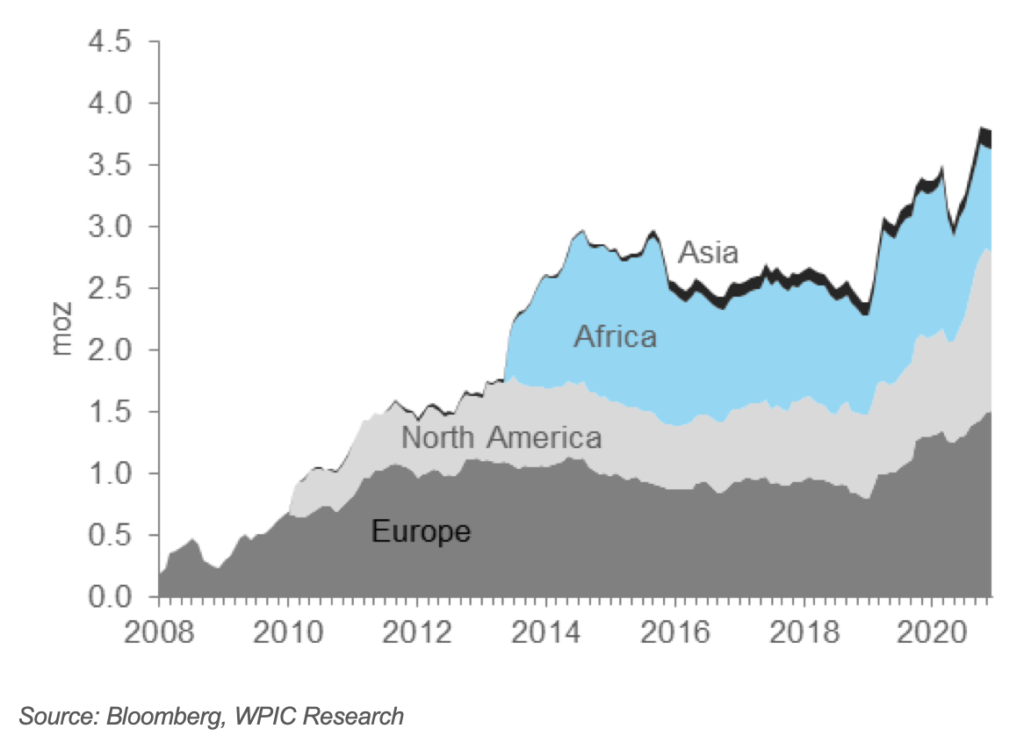

In the past 40 years, there have been only 2 years where net physical disinvestment has occurred, in 2000 and 2005. On average, investors have added c.320 koz a year to physical holdings since 1980. Bar and coin demand has dominated investment accumulation, with holdings tending to be long-term, with ownership frequently passed intergenerationally. ETF investment holdings, since first launched in 2007, have seen positive uptake in 11 of 14 years. (Figure 2)

Annual Pt investment has seen positive physical investment uptake in 38 of the last 40 years

Bar & coin has dominated the accumulation of c.12.8 moz of physical investment holdings since 1980

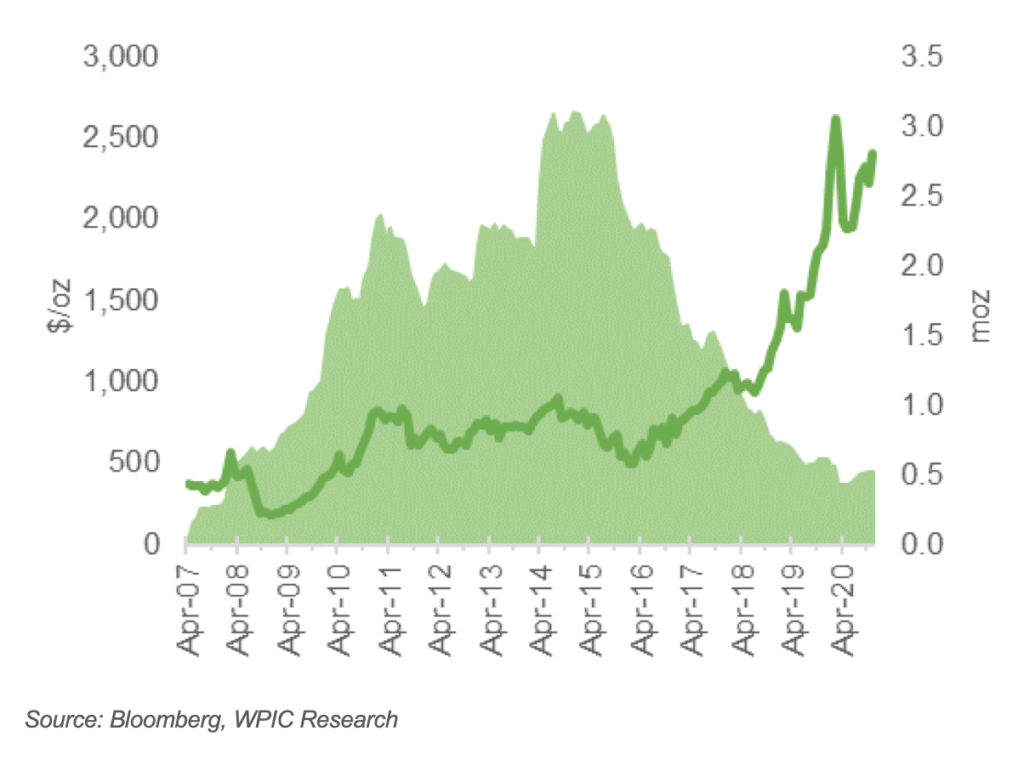

Palladium ETF liquidation is frequently argued to support the claimed platinum price risk; holdings reduced by c.2.6 moz since 2014. However, palladium disinvestment occurred after the price had doubled and continued as the price subsequently doubled again (Figure 6). Until the platinum price doubles at least, or rises well above the gold and palladium prices, this risk of ETF selling looks minimal.

Investors currently have a strong incentive to maintain and build holdings due to: platinum automotive substitution for palladium; strong HD and LD diesel demand growth (tighter emissions and EU CO2 fines) and investment demand growth from burgeoning interest in platinum’s key role in the hydrogen economy (electrolysers and fuel cell vehicles).

Platinum automotive recycling supply is typically price inelastic, with growth in supply a predictable function of historic vehicle scrappage rates and pgm loadings when manufactured. Rising platinum prices are unlikely to elicit any meaningful growth in recycling supply.

Platinum’s attraction as an investment asset arises from:

– Supply is relatively constrained with limited investment in new platinum group metal (PGM) mines

– Platinum price is near all-time lows relative to gold and at record lows relative to palladium

– Total PGM demand growth should continue due to increasingly restrictive emissions rules

– Market balance and price mismatches between palladium and platinum argues for substitution – Investment demand has surged as institutions begin to factor low price and positive fundamental outlook

Figure 1: Platinum Bar and Coin investment has seen positive uptake in 36 of the past 40 years, accumulating c.8.7 moz

Figure 2: Platinum ETF uptake trends have been positive for 11 of the 14 years since products were launched in 2007

Figure 3: Short-term platinum price moves are driven by changes in investor futures positioning

Figure 4: In all but 5 of the last 40 years, the normal relationship between balance and price (green boxes) has held. 2012-2016 above ground stock liquidations

Figure 5: Excluding investment from market balance analysis shows significantly lower degree of correlation with price than when investment is included

Figure 6: Liquidation of palladium ETF holdings only occurred after prices doubled between 2016 and 2018, and doubled again between 2018 and 2020

Information source: World Platinum Investment Council