3 Reasons to invest in Platinum

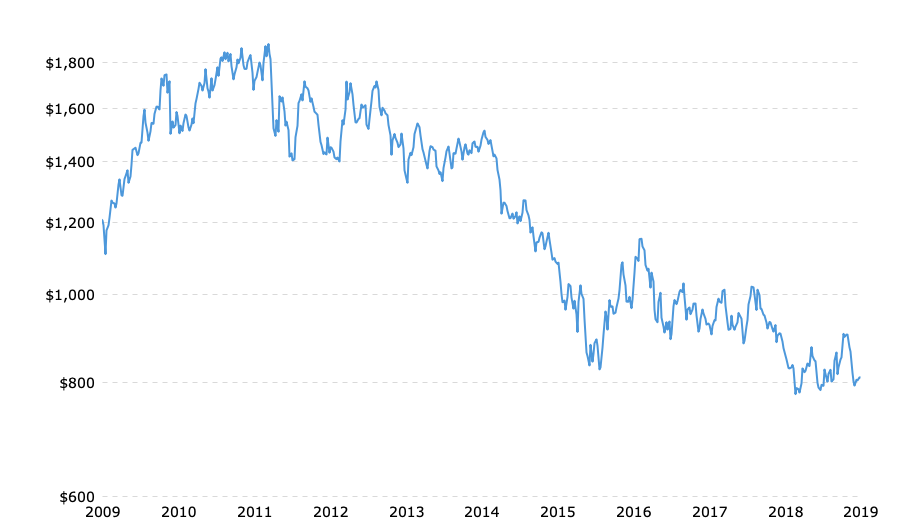

Platinum has been more valuable than gold in most of the past, and platinum has traded 34% more than gold in the past few decades.

Today, the price of gold is about $1,500. Therefore, if the trading price of platinum is in line with its historical premium over gold, the trading price of platinum should exceed $2,000 per ounce, just like the price in 2008.

Despite the recent surge in platinum spot prices, platinum is trading at less than half of its historical average. New demand drivers, coupled with a reduction in oversupply, and current low prices, prove that Platinum is fighting back from recent struggles and still shines in every bullion portfolio.

2019 1OZ CANADA MAPLE LEAF .9995 PLATINUM BU

2020 1 OZ AUSTRALIA LUNAR SERIES III YEAR OF THE MOUSE 9995 PLATINUM COIN

It is impossible to time the markets or know exactly how high platinum is headed, but we do know that in the next few years, platinum demand is expected to increase more than supply steadily. This metal is no longer relying on old sources of demand, but finding new uses in industry and once again attracting long-term investors.

Although platinum is often overlooked by many investors, there are several more reasons to invest in platinum, including:

1. Limited supply:

Platinum is much rarer than gold and silver. The world’s annual production is only about 8 million ounces, accounting for only 10% of the world’s annual gold production.

2. Demand growth:

The demand for platinum in the industrial and investment sectors is growing, so the demand for investment in platinum is also increasing.

2019 1 OZ SOUTH AFRICA BIG FIVE ELEPHANT .9995 PLATINUM PROOF COIN

2017 1/4 OZ BRITAIN THE PLATINUM WEDDING – ANNIVERSARY OF HER MAJESTY THE QUEEN .9995 PLATINUM PROOF COIN

3. Price performance:

Precious metals tend to perform well under adverse economic conditions, and platinum is no exception.

Platinum is still at a historically low level due to the struggle between platinum and its sister metal palladium. Yet, platinum is due for a major rally, and savvy investors know that when sentiment is poor, it actually provides to most opportunity to stock up on under-rated and undervalued assets.